For a majority of the modern economy, there was no such thing as credit scores. There were only credit reports and lender judgements. Credit scores arrived in the 1950s but only became prominent in the 1970s. Before credit scores, if you wanted a loan, you go to a bank and apply for it. The lender would determine if you are credible or not. The decision would be decided based on the lender judgement. This judgement was risky, and it is not a viable way to determine whether a person is credible, and this process tended to be discriminatory. In 1956, FICO (known at the time as Fair Issac) founded by Bill Fair and Earl Issac, two statisticians whose specialty was analytical solutions. However, in 1958, they introduced a scoring system base on human behavior. This scoring system is used to analyze a customer’s creditworthiness. This credit scoring is known worldwide, and it has made credit more widely used. Their goal was to create a scoring system that would take the lender’s judgement out of lending. They emphasized the correlations of behaviors that made a good credit risk and behaviors that made a bad credit risk. The algorithm they created was called the FICO Score. The primary components and weights of your score are your history of payments, the debts you owe and the amount, your credit history length, your new credit and your credit mix. In 1970, the Fair Isaac Company started providing scoring systems to lenders, to be used to determine their customer creditability. FICO updated their proprietary algorithm as needed throughout the years. The updates are done to keep the algorithm current and to create a more accurate model of borrower behaviors.

In the 1970s, the credit score became important in lending around the world. This importance prompted a need to protect consumers. So, in 1974, The Fair Credit Billing Act was passed. The law was passed to protects consumers from unfair credit billing practices. With this law, consumers have rights. The right to dispute inaccuracies is included in the Act. The customers are allowed 60 days after a transaction to dispute a charge. The law provides consumers with the right to access their credit report. Every customer is allowed a yearly free credit report from all three credit bureaus. It also will enable consumers to time-limits for negative information. Late payments and defaults remain on your credit report for seven years, and bankruptcies stay on your credit report for ten years. This law is essential because all or most transactions are recorded on your credit report. The credit report needs to be accurate. Credit bureau uses credit report information to generate your credit scores.

In 1981, Fair and Issac developed the credit bureau risk score. This credit score is vital because of the demand by consumers for a more objective way to make decisions and the credit score is less discriminatory. The far more significant role of the credit score is it essential to the American economy. In 1989, modern updates were made to the FICO Score. These updates were based solely on the credit report. FICO began creating three-digit credit scores. Credit score ranges were developed to identify poor and excellent credit. Each credit bureaus follow suit with a version of their scoring system. Herein, is where we find the difference between FICO scores and credit scores. The credit scores and the FICO Score are both generated models to predict risk, but they are created by different companies. The credit score is a proprietary model created by the credit bureau. The FICO Score is by created by Fair Isaac Corporation (FICO).

The credit reporting agencies are private businesses, but they’re subject to government regulation. They collect information which is not accessible to the average person. The credit agencies collect and manage information and create credit reports based on that information. Lenders use credit scores and credit reports to determine your creditworthiness. Establishing and improving your credit score is a long term process. The first step to good credit is to request a copy of your credit report from all three credit bureaus. The credit bureaus are Experian, Transunion and Equifax. If a computer is not available, you can call the credit bureaus and request a report, and it will be sent to you by mail. You should check your credit report from all credit bureaus because the credit reports and credit score can be different. Everyone is entitled to a free credit every year. If however you are denied credit, you can receive a free credit report from the credit bureau that was instrumental in that decision. All three credit reports should be reviewed yearly because unfamiliar transactions can be detrimental to your credit score. Also, judgements against you such bankruptcies can significantly reduce your credit score. For your convenience, a transaction can be disputed online as well by phone.

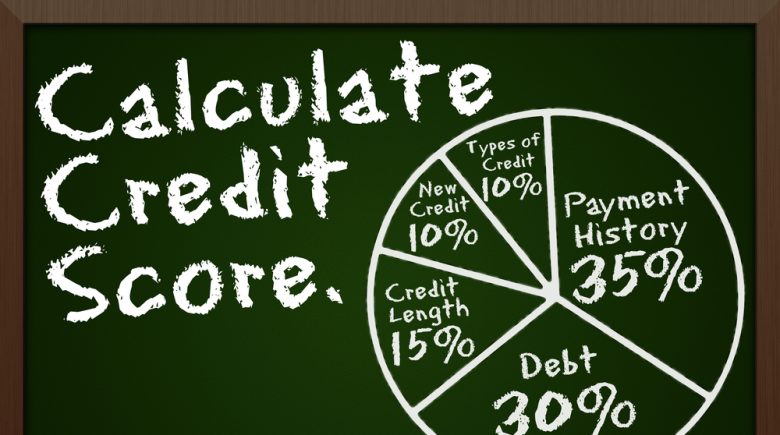

Upon receipt of your credit reports, you should review and analyze the five factors that affect your credit scores. They are your payment history, the debt you owe and the amount, your credit history length, your new credit and your credit type. There are few considerations use to calculate your score. These considerations can be used to lower your credit score, but changes take time to manifest, so be patient. It would help if you started with your payment history because it is 35 per cent of your score. Your payments must be made on time. Missed payments and late payments are reported to the credit bureaus, and they will affect your credit score. It would help if you tried to make your payments on or before the due date. The amount you owe is significant because it is 30 per cent of your score. The metric that is used looks at the amount you owe as a percentage of your maximum credit. The utilization for credit is 30 per cent. This limit on spending may be difficult if you are trying to establish credit, but this percentage can prove your creditworthiness in the long term. Do not to max out your credit cards. The length of credit history is essential because it is 15 per cent. The average age and the age of your credit accounts is considered. The dates of utilization and opened dates are used to determine risk. The preferred age of a credit line is over two years. People with excellent credit scores may have more than 25-year credit history. The next factor is new credit, which is 10 per cent of your credit score. You should not open a lot of new credit cards at one time. Too many credit card shows that you are a considerable risk for default. The last factor is credit mix, which 10 per cent of your credit score. A variety of credit cards are, for example, a car loan and a credit card. It would help if you tried to use the credit card for emergencies only. A mix of credit represents a better risk. If you think you need help with a plan to improve your credit score, there are reputable credit repair companies available. However, do your research. Some companies offer to consolidate your credit cards, and you make one low monthly payments. However, this option will decrease your credit score.

Some of the advantages of possessing a high credit score are that it is an excellent negotiating tool; it is easy to negotiate more affordable payment plans, better rates of interest on your credit accounts, and even excellent insurance prices.

For a majority of the modern economy, there was no such thing as credit scores. There were only credit reports and lender judgements. Credit scores arrived in the 1950s but only became prominent in the 1970s. Before credit scores, if you wanted a loan, you go to a bank and apply for it. The lender would determine if you are credible or not. The decision would be decided based on the lender judgement. This judgement was risky, and it is not a viable way to determine whether a person is credible, and this process tended to be discriminatory. In 1956, FICO (known at the time as Fair Issac) founded by Bill Fair and Earl Issac, two statisticians whose specialty was analytical solutions. However, in 1958, they introduced a scoring system base on human behavior. This scoring system is used to analyze a customer’s creditworthiness. This credit scoring is known worldwide, and it has made credit more widely used. Their goal was to create a scoring system that would take the lender’s judgement out of lending. They emphasized the correlations of behaviors that made a good credit risk and behaviors that made a bad credit risk. The algorithm they created was called the FICO Score. The primary components and weights of your score are your history of payments, the debts you owe and the amount, your credit history length, your new credit and your credit mix. In 1970, the Fair Isaac Company started providing scoring systems to lenders, to be used to determine their customer creditability. FICO updated their proprietary algorithm as needed throughout the years. The updates are done to keep the algorithm current and to create a more accurate model of borrower behaviors.

In the 1970s, the credit score became important in lending around the world. This importance prompted a need to protect consumers. So, in 1974, The Fair Credit Billing Act was passed. The law was passed to protects consumers from unfair credit billing practices. With this law, consumers have rights. The right to dispute inaccuracies is included in the Act. The customers are allowed 60 days after a transaction to dispute a charge. The law provides consumers with the right to access their credit report. Every customer is allowed a yearly free credit report from all three credit bureaus. It also will enable consumers to time-limits for negative information. Late payments and defaults remain on your credit report for seven years, and bankruptcies stay on your credit report for ten years. This law is essential because all or most transactions are recorded on your credit report. The credit report needs to be accurate. Credit bureau uses credit report information to generate your credit scores.

In 1981, Fair and Issac developed the credit bureau risk score. This credit score is vital because of the demand by consumers for a more objective way to make decisions and the credit score is less discriminatory. The far more significant role of the credit score is it essential to the American economy. In 1989, modern updates were made to the FICO Score. These updates were based solely on the credit report. FICO began creating three-digit credit scores. Credit score ranges were developed to identify poor and excellent credit. Each credit bureaus follow suit with a version of their scoring system. Herein, is where we find the difference between FICO scores and credit scores. The credit scores and the FICO Score are both generated models to predict risk, but they are created by different companies. The credit score is a proprietary model created by the credit bureau. The FICO Score is by created by Fair Isaac Corporation (FICO).

The credit reporting agencies are private businesses, but they’re subject to government regulation. They collect information which is not accessible to the average person. The credit agencies collect and manage information and create credit reports based on that information. Lenders use credit scores and credit reports to determine your creditworthiness. Establishing and improving your credit score is a long term process. The first step to good credit is to request a copy of your credit report from all three credit bureaus. The credit bureaus are Experian, Transunion and Equifax. If a computer is not available, you can call the credit bureaus and request a report, and it will be sent to you by mail. You should check your credit report from all credit bureaus because the credit reports and credit score can be different. Everyone is entitled to a free credit every year. If however you are denied credit, you can receive a free credit report from the credit bureau that was instrumental in that decision. All three credit reports should be reviewed yearly because unfamiliar transactions can be detrimental to your credit score. Also, judgements against you such bankruptcies can significantly reduce your credit score. For your convenience, a transaction can be disputed online as well by phone.

Upon receipt of your credit reports, you should review and analyze the five factors that affect your credit scores. They are your payment history, the debt you owe and the amount, your credit history length, your new credit and your credit type. There are few considerations use to calculate your score. These considerations can be used to lower your credit score, but changes take time to manifest, so be patient. It would help if you started with your payment history because it is 35 per cent of your score. Your payments must be made on time. Missed payments and late payments are reported to the credit bureaus, and they will affect your credit score. It would help if you tried to make your payments on or before the due date. The amount you owe is significant because it is 30 per cent of your score. The metric that is used looks at the amount you owe as a percentage of your maximum credit. The utilization for credit is 30 per cent. This limit on spending may be difficult if you are trying to establish credit, but this percentage can prove your creditworthiness in the long term. Do not to max out your credit cards. The length of credit history is essential because it is 15 per cent. The average age and the age of your credit accounts is considered. The dates of utilization and opened dates are used to determine risk. The preferred age of a credit line is over two years. People with excellent credit scores may have more than 25-year credit history. The next factor is new credit, which is 10 per cent of your credit score. You should not open a lot of new credit cards at one time. Too many credit card shows that you are a considerable risk for default. The last factor is credit mix, which 10 per cent of your credit score. A variety of credit cards are, for example, a car loan and a credit card. It would help if you tried to use the credit card for emergencies only. A mix of credit represents a better risk. If you think you need help with a plan to improve your credit score, there are reputable credit repair companies available. However, do your research. Some companies offer to consolidate your credit cards, and you make one low monthly payments. However, this option will decrease your credit score.

Some of the advantages of possessing a high credit score are that it is an excellent negotiating tool; it is easy to negotiate more affordable payment plans, better rates of interest on your credit accounts, and even excellent insurance prices.